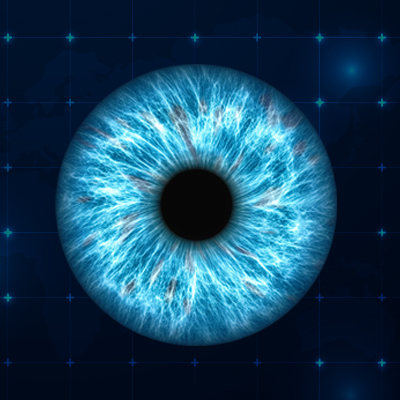

When the concept of blockchain technology was first outlined in the early 90s, many considered it a breakthrough technology that would have a profound impact on economic transactions. The transformative nature of the blockchain relies on its decentralized nature, enabling multiple parties to secure data and transactions without having to rely on any central authority.

While the conventional understanding of the blockchain often revolves around its use in verifying cryptocurrency transactions, the growing implications of the technology enable it to fundamentally reshape the way we do business.

For one, the independent node constructs within the blockchain allow for multiple verifications of each transaction. Multiple copies of the ledger ensure that transactions cannot be changed. Thus, while malicious actors may successfully change the record on one or two nodes, the inherent consensus mechanisms would throw those changes out. The end result is a highly secure database that can synchronize all nodes in real-time, meaning transactions records are not only secure but also highly efficient. The immutable nature of the underlying record mechanism enables a higher level of confidence.

Enter Tokenization

Because blockchain technology ensures transactions can be recorded quickly and securely, a natural progression of the technology is to use it for transferring rights to digital assets.

Tokenization refers to the process of creating and distributing asset-backed digital securities on the blockchain. These asset-backed securities are referred to as digital security tokens, which represent an ownership stake within the underlying asset as an investment vehicle.

While theoretically, any asset can be tokenized, the process is highly desirable for raising capital. Companies can issue tokens that represent an equity stake within the company, similar to an IPO. Raising capital via tokenization would start with a Security Token Offering (STO), enabling investors to purchase units of ownership of the company via security tokens.

Both token issuers and investors benefit from the tokenized environment within the blockchain, as the process is highly transparent, and through the use of smart contracts, transactions can seamlessly be recorded while following strict conditions.

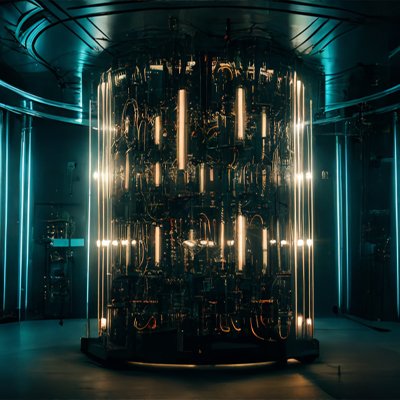

AI Meets Blockchain

By leveraging the immutable aspects of blockchain technology, artificial intelligence can be used in conjunction with the blockchain to mitigate traditional barriers to raising capital.

While larger firms generally have no significant obstacles when it comes to raising funds, smaller funds often run into considerable problems. For one, institutional investors are more reluctant to finance smaller companies through debt as they generally have a higher risk profile. While equity investors such as venture capital firms offer a middle-ground solution, the process generally favors the equity investor and creates a highly asymmetrical benefit.

Leveraging AI with blockchain allows for significantly reduced overhead and administrative costs associated with financing, as smart contracts can ensure all applicable conditions are met prior to an STO going live. The end result is a more cost-effective and timely process of raising capital for a business or project.

At its core, AI is designed for efficiency and eliminating human error, while blockchain is designed for transparency and immutability. By combining the two, our blockchain investment bank can offer clients a platform to raise capital securely and efficiently for various project needs.

Piggyback Technology

Because of the dynamic use cases for AI and blockchain-based platforms, a natural progression within industries leveraging such technology would be to offer multiple solutions through overlapping technologies.

The same underlying mechanisms that allow a company or individual to raise capital for their business can be further utilized to power a derivatives market. Companies that can effectively market such technologies to clients to raise capital can then further market the same digital assets within their platform. Now you can have a source not only to raise capital via an initial offering but also enable a secondary market to see the value of that asset continue to grow.

While it is true that blockchain technology is no longer in its infancy, the future prospects and potential have yet to be written. As advancements in artificial intelligence and machine learning continue to grow, similar advancements in blockchain technology have yet to be realized. Companies deemed pioneers in leveraging the two technologies, then are in the best position to capture the full synergies between the two.

Canadian securities regulators need to modernize and adopt a legal framework for advancement in digital security technologies to move with the rapid advancements of this new paradigm.